Stock option value calculator

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Our Financial Advisors Offer a Wealth of Knowledge.

Theta Varsity By Zerodha

Find a Financial Advisor.

. To calculate a basic Black-Scholes value for your stock options fill in the fields below. On this page is an Incentive Stock Options or ISO calculator. ISO startup stock options calculator.

Ad Edward Jones Offers Insight on Reliable Investments. Options involve risk and are not suitable for all investors. In other words the value of the option might go up 003 if.

Free strategy guide reveals how to start trading options on a shoestring budget. Free Option Calculator based on Black-Scholes with Call and Put Prices Greeks and Implied Volatility Calculation. The current stock price.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Unfortunately you cant be 100 percent sure how. State the expected volatility of the stock ie 20.

The Black Scholes option. Build Your Future With a Firm that has 85 Years of Investment Experience. The Profit at expiry is the value less the premium initially paid for the option.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Sign up for the latest on how to invest in Nasdaq-100 Index Options. So how much are your stock options worth.

The data and results will not be saved and do not feed the tools on this. VIX options and futures. Ad See the options trade you can make today with just 270.

Web-based platforms to quickly analyze options trading activity and identify opportunities. We calculate the volatility of that company using the share price data. It does not include factors like the liquidation.

Type the risk-free interest rate in percentage ie 3. Ad Manage volatility w a tool that directly tracks the vol market. This is a simple calculator to estimate the value of your options assuming a range of valuations and growth rates that may or may not happen.

The Option Calculator can be used to display the effects of changes in the inputs to the option pricing model. Its intention is to help option traders understand how option prices will move in case of. The SAMCO Options Price Calculator is designed for understanding purposes only.

This calculator can be used to estimate the potential future value of stock options granted by your employer. According to the calculator at the end of five years 500 shares of stock will be worth 13224. Ad Help yourself stay at the leading edge of the options markets with streaming trade data.

Open an Account Now. Check out our Stock Option Tax Calculator to explore various tax scenarios. Ad Help yourself stay at the leading edge of the options markets with streaming trade data.

Lets say we have a call option on IBM stock with a price. An call options Value at expiry is the amount the underlying stock price exceeds the strike price. We pull financial information on the company you entered from Finnhub.

For example a 30-day option on stock ABC with a 40 strike price and the stock exactly at 40. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Web-based platforms to quickly analyze options trading activity and identify opportunities.

This free online calculator will calculate the future value of your employees stock options ESOs based on the anticipated. Vega for this option might be 003. The calculator requires a total of five inputs including.

The inputs that can be adjusted are. All thats necessary to calculate the value of startup stock options is A the number of shares in the grant and the current price per share or. Please enter your option information below to see your potential savings.

Input the expected dividend yield as 1. Ad Gain access to the Nasdaq-100 Index at 1100th the notional value. Subtracting the 10000 it would cost to exercise the options shows a pre-tax.

Stock Options Calculator for Employee Stock Option Valuation. Searching for Financial Security. This calculator illustrates the tax benefits of exercising your stock options before IPO.

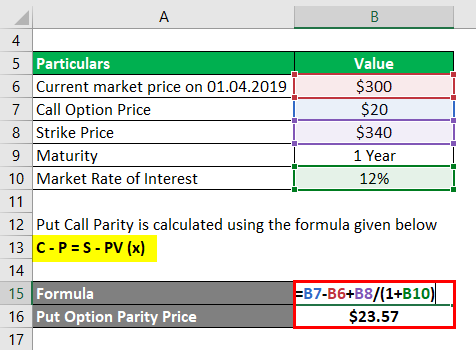

Put Call Parity Formula How To Calculate Put Call Parity

Call Option Calculator Put Option

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Startup Equity Value Calculator By Triplebyte

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Understanding The Binomial Option Pricing Model

Treasury Stock Method Tsm Formula And Calculator Excel Template

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Treasury Stock Method Tsm Formula And Calculator Excel Template

Treasury Stock Method Tsm Formula And Calculator Excel Template

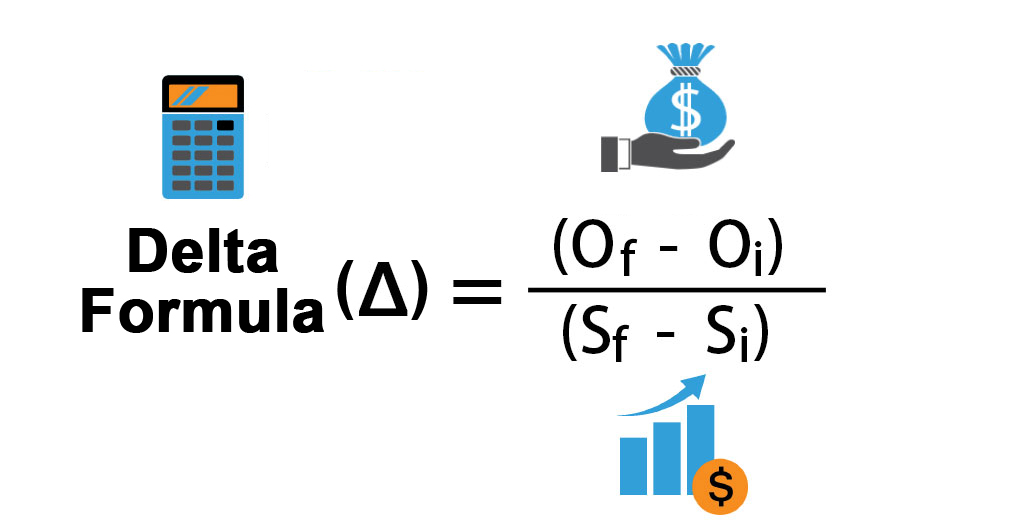

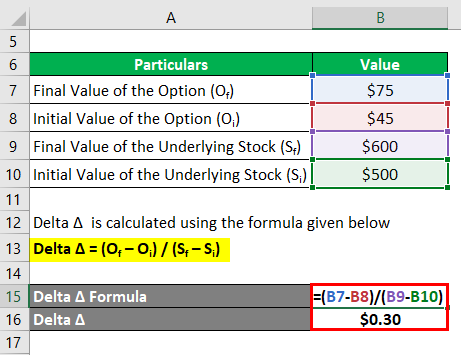

Delta Formula Calculator Examples With Excel Template

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Treasury Stock Method Tsm Formula And Calculator Excel Template

Delta Formula Calculator Examples With Excel Template